E-Invoicing Obligation: The Future of E-Invoicing in Germany

Table of contents:

- How far along is Germany in terms of e-invoicing?

- What plans does the new government have?

- How has e-invoicing been implemented in other countries?

- What opportunities does mandatory e-invoicing provide?

- E-invoicing obligation: Conclusions

Electronic invoices are now an elementary component of digital business processes. However, the standardization of e-invoice formats and processes is already the first hurdle. What exactly is "the" standard - XRechnung, ZUGFeRD , EDI invoice?

How far along is Germany in terms of e-invoicing?

The XRechnung format has been mandatory in the public sector throughout Germany since November 2020. At least that was the original plan. What was supposed to be a simplification and a boost for digitization turned into a patchwork of federal regulations, some of which were quite complicated. This is because each federal state introduced its own specifications and deadlines. As a result, it is often unclear to many companies operating in the business-to-government (B2G) sector what requirements individual public invoice recipients have.

This is aggravated by the fact that some recipients use multiple digital "receiving addresses" - the route ID. For example, the Federal Office of Bundeswehr Equipment, Information Technology and In-Service Support (BAAINBw) sometimes has its own route ID for individual departments. But the challenges with regard to XRechnung do not stop here because this format is constantly changing. As a result, invoicing parties also have to make regular adjustments at the technical level, for example, in order to be able to operate new mandatory fields.

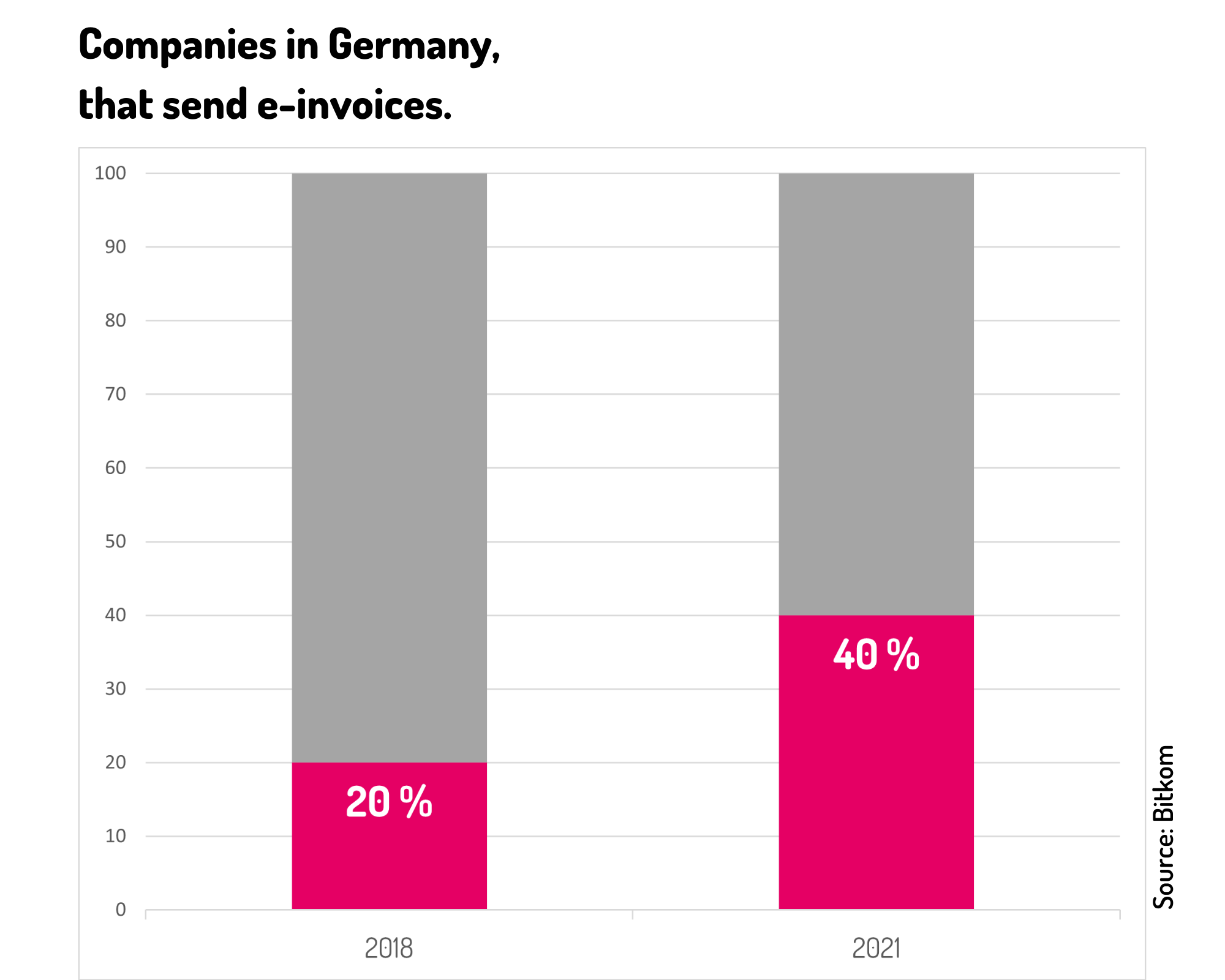

However, XRechnung is not the only e-invoicing standard. Other formats, such as ZUGFeRD or various EDI invoices, are also used in the B2G and business-to-business (B2B) sectors. Many companies need to be able to both send and receive several of these formats. According to a survey by Bitkom (Germany's digital association), e-invoicing is generally gaining acceptance in Germany. One result confirmed that four out of ten companies were already sending e-invoices in September 2021. Three years earlier, it was only one in five companies.1

What plans does the new government have?

The new coalition has clearly committed to the following in the coalition agreement:

“We will continue to fight VAT fraud. This path is to be intensified in cooperation with the Länder . As quickly as possible, we will introduce an electronic reporting system nationwide, which will be used for the creation, verification and forwarding of invoices. In this way, we will significantly reduce the susceptibility to fraud of our VAT system and modernize and at the same time reduce the bureaucracy of the interface between the administration and the businesses. We will campaign at EU level for a definitive VAT system (e.g. reverse charge).” 2

The government's motivation to combat VAT fraud is comprehensible, especially in light of the fact that other countries have certainly had success with uniform e-invoicing and central reporting systems. The claim of modernization and reduction of bureaucracy is also very laudable and, if successful, would be greatly appreciated by all sides. The statement on nationwide uniformity is particularly interesting because it would prevent a federal patchwork, as is the case with XRechnung.

However, this would require the federal states to follow suit. Whether this can be achieved remains to be seen. In the end, it could quickly lead to a situation in which there are once again different requirements depending on the federal state. The question of whether there will be amount limits indicating when an e-invoice is to be issued is also still up in the air. Another important, unanswered question concerns the technical side.

When looking across the borders into neighboring countries, there are various approaches to this. One option is to make it compulsory to link up with XRechnung and process it via a central portal that also serves as a civil register. Another approach could be to collect all e-invoices and send them to a register at the end of the month. Similar variants are already being used in other European countries.

It can be assumed that there will be portals to which invoices can be uploaded and automatically converted into the appropriate format. Unfortunately, experience with XRechnung has also shown that technical difficulties can arise here, which can hardly be resolved without specific expertise.

How has e-invoicing been implemented in other countries?

Several countries are using e-invoicing in different variants. Italy, for example, has now made FatturaPA mandatory for B2B and B2G. In this case, e-invoices are sent via a central interface. All invoices that do not follow this route are considered undelivered and are sanctioned. For smaller companies, there is the option of uploading their invoices to a central portal. However, this involves a great deal of manual effort.

In Poland, the use of e-invoicing has so far been voluntary. However, companies are required to send their invoices collectively to a central register at the end of the month. In the future, e-invoicing is to become mandatory as well.

In many other countries, such as Spain, Finland, the Netherlands and Belgium, e-invoicing is currently only mandatory in B2G. In Finland, companies can decide for themselves whether they will only accept e-invoices. In the UK, all companies are to create their e-invoices digitally and manage them via a central interface from April 2022.

It is apparent that in the next few years there will be changes abroad regarding e-invoicing. Companies operating there will have to be prepared accordingly. A discernible trend is also the use of central interfaces. In the future, e-invoicing should be aligned with these interfaces and adjusted accordingly when new versions or specifications are created.

What opportunities does mandatory e-invoicing provide?

Invoice processing is often unnecessarily time-consuming, especially when it comes to the receipt of invoices. Many manual steps, such as cross-checking, editing and entering the data in the company's own system, cost time and can be potential sources of error. In addition, complex invoice releases and verifications are a challenge for any company. Currently, various systems are already in use that perform many tasks digitally and automatically. Even then, however, there can still be considerable manual effort, because data quality also plays a crucial role, as the following questions illustrate:

• Was a PDF invoice read correctly?

• Is the creased paper invoice that was scanned easily readable?

• Was an unusual invoice format used?

• Is all relevant data in the invoice?

All these factors influence the amount of manual extra work that the accounting department ultimately has to do. Nowadays, when sending an invoice, it is also necessary to check in which format invoices can be received. Mailing by paper in particularly incurs costs for paper, postage, and manual tasks.

E-invoicing eliminates many of these problems as it always provides perfect data quality. In addition, mandatory fields have to be filled in correctly so that the invoice can be sent after all. On the basis of these benefits, automation can be extended to work with 2-way or 3-way matches between purchase order, goods receipt and invoice. Furthermore, the internal release can be optimized and automated, also based on the data quality.

E-invoicing obligation: Conclusions

In principle, the e-invoicing obligation provides a great opportunity to promote digitization and automation. Benefits such as process optimization and minimization of human errors are obvious. Politically, the intention is there, if only to reduce the loss of sales tax revenue and to drive digitization forward. However, much will depend on the extent to which uniformity can be achieved between the federal and state levels. Scenarios from other countries indicate that it can work out well, regardless of which path is ultimately taken.

It is without question that an e-invoicing obligation will also be a challenge, both on the organizational and technical side, as e-invoicing is always changing, which is evident from the example of XRechnung. In addition, the technical implementation and use of e-invoicing is costly and requires special expertise. In conclusion, it is only a question of time when the e-invoicing obligation will be introduced. It is therefore advisable to prepare for it now.

More on Topic: »First Year of XRechnung and All Is Good?«

Sources:

1 Bitkom-Survey; September 2021; „Electronic invoices are becoming more widespread“;

2 Coalition Agreement 2021–2025 signed by the Social Democratic Party (SPD), the Greens (Bündnis 90/Die Grünen) and the Free Democratic Party (FDP), www.spd.de